Claiming WFH costs is becoming impractical.

It's too late for taxpayers to start a fixed rate logbook.

Starting now only has a small benefit. It's hardly worth it.

Actual cost is complicated and has high overheads.

Who has time to explain apportionment and then manually check every client's energy usage? Not us.

The only way to receive standardised, digital actual cost logbooks from all of your clients.

Cloud-based, backed up and audit ready.

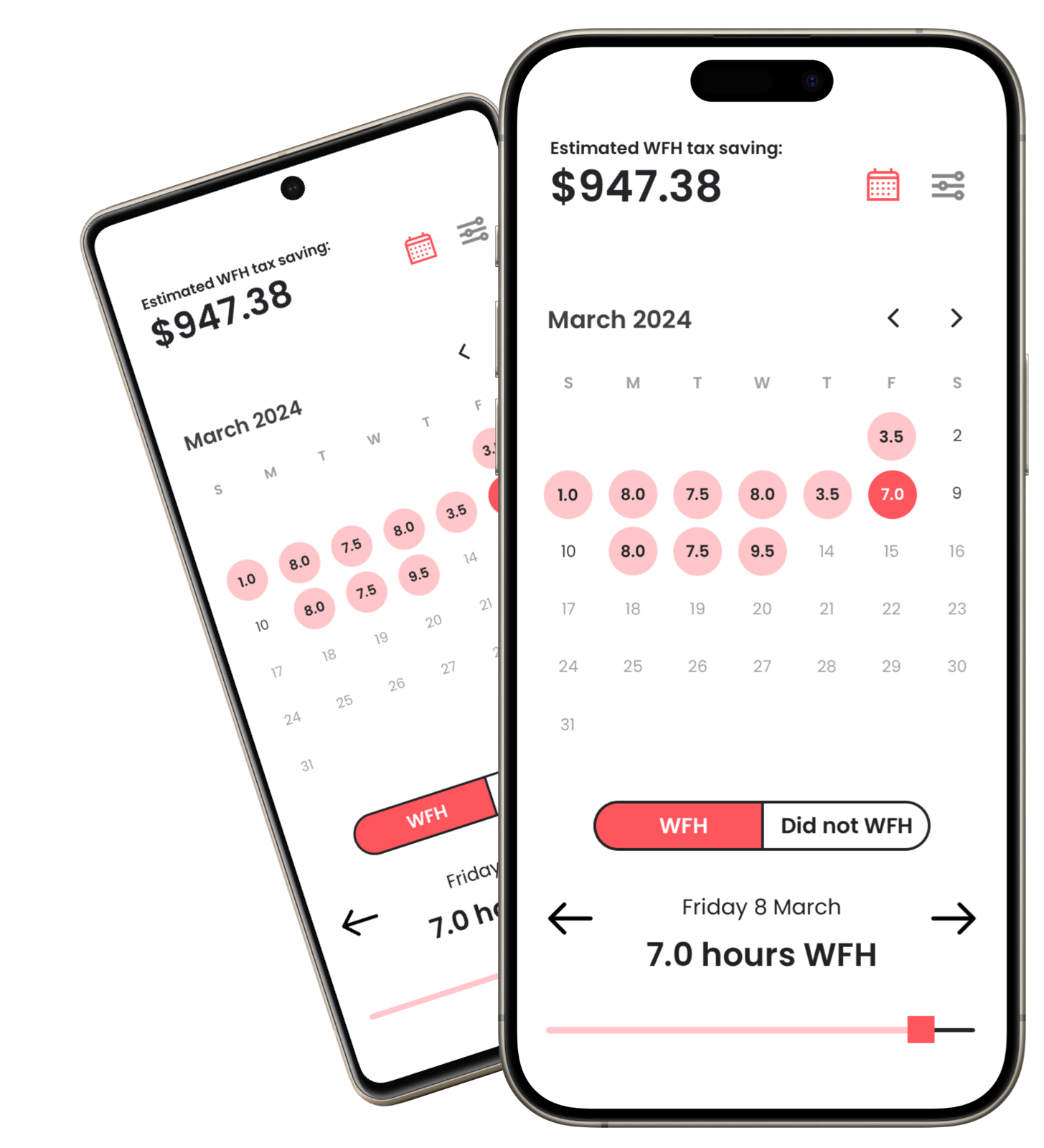

We built From Home from the ground up so that taxpayers can make actual cost logbooks with zero external guidance.

Free for accountants. $14.99 for taxpayers.

Our simple pricing keeps money in your client's pockets and makes your life easy.

Try our estimator to see how circumstances affect claims.

Use our email template, or write your own.

Hello,

The ATO now requires a detailed logbook for WFH tax claims. "From Home" is a new app that offers an intuitive solution to manage your deductions with full compliance.

You still have time to start your logbook so that you can make a valid claim.

"From Home" Advantages:

- Meets ATO Mandate: Directly aligns with the latest time tracking requirements.

- Easy Use & Secure: Logs and stores your WFH data for easy retrieval.

- Audit-Ready: Be prepared, with everything organized for potential audits.

From Home has an estimator to show how much tax you could save. For many taxpayers, this will be $1,000+.

Visit https://fromhome.co today.

Regards,